When it comes to saving for retirement, there is no shortage of investment vehicles from which to choose. The most common is the Individual Retirement Account, or more commonly known as the IRA. There are two types of IRAs: a Traditional IRA and a Roth IRA.

A question I get asked time and time again is “Which one is better?”

Like most answers in the world of financial advising, it depends on a number of factors but it really boils down to two questions:

- Are you looking to decrease your current tax liability?

- Are you looking for tax-free income in retirement?

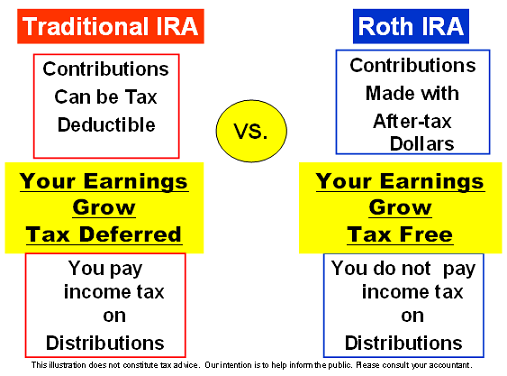

Below is an illustration that shows the main differences between a traditional IRA and a Roth IRA.

Now let’s take a look at how your choice could impact your retirement.

Hypothetical Situation: Alan starts saving for retirement at age 25. He decides to use the Traditional IRA. He contributes $300 each month for 40 years at which point he would be age 65. Assuming a hypothetical 9% rate of return, Alan would have around $1,415,229.05 in his Traditional IRA. He decides to use the 4% rule which means he will take 4% of his account value annually regardless of what the market does. By not taking more than 4%, Alan has a very good chance of not outliving his retirement. Alan will withdraw $56,606.56 each year. He will also have to pay taxes on it. Assuming the tax rates do not change over the next 40 years (HIGHLY unlikely) and that Alan lives in Alabama, Alan will only receive approximately $44,121 after taxes (based on 2018 tax numbers).

However, if Alan had chosen a Roth IRA, he would be able to enjoy the entirety of the $56,606.56 each year without owing any taxes. If Alan needed at least $56,606.56 each year after taxes, he would have to withdraw approximately $72,573 each year (assuming his overall tax rate–combining federal and state taxes–stays at the same 22%). This would increase his annual withdrawal to 5% of his account balance and further increase the risk of him outliving his money.

Does this mean that the Roth IRA is better than the Traditional IRA? No, it just means that they work differently and while one may work for one individual it may not be appropriate for another.

Check the background of your financial professional on FINRA’s BrokerCheck.

Securities offered through Concourse Financial Group Securities, Inc. (CFGS), Member FINRA/SIPC. Advisory services offered through Concourse Financial Group Advisors, a DBA for CFGS, a Registered Investment Advisor. Steve Tucker, Jr. and STJ Advising is independent of CFGS.

Securities offered through Concourse Financial Group Securities, Inc. (CFGS), Member FINRA/SIPC. Steve Tucker, Jr. and ST is independent of CFGS.